Equity option competition in Europe

/“Liquidity is sticky” is an often heard quote when competition between exchanges is discussed. So when TOM announced that they were taking on Euronext back in 2009 it was met with skepticism. Now in 2015 we see TOM at approximatively 30%. However, in his own column Willem Meijer, the CEO, claimed a 45% market share noting also that once Eurex reached a 50% market share competing for the Bund future, all remaining volume quickly followed. It looks like TOM is aiming for that magical 50%, hoping that history repeats. It’s perhaps also an explanation why they make a huge effort to polish the numbers, pushing the percentage as high as possible. The truth is however that TOM never reached a 45% market share and that the market share has been stagnant for the last couple of months.

TOM’s quick rise

Market share in dutch equity options

TOM was able to absorb their market share through a deal with Binckbank, the largest retail broker in the Netherlands. Binck was one of the co-founders and gave their clients a very simple choice; Dutch equity options would only be executed on the TOM platform and nowhere else. A bold but well executed plan and once the flow started coming in, others quickly joined. In extremely broad terms, Binck and their partners found a very creative and effective structure to internalize flow. This explains how TOM could eat away Euronext’s market share as published on their website, now at 41% of the total Dutch market. Now, you may wonder why you cannot find the 41% on this graph. TOM conveniently forgets to incorporate the Eurex volume, also a competitor in the Dutch equity option space with mostly institutional flow. Hence, the graph above takes into account all available data and might still not be correct as Euronext publishes larger figures on their volume than TOM gives them credit for.

What’s driving these changes in the Netherlands?

For the Dutch market, the answer seems to be easy, Euronext’s excessive fees were just not attractive for the active Dutch retail community. Also technical issues were probably coming into play when Euronext had some problems offering a stable platform. Eurex was also offering low fees, actually half of TOMs, but were never accessible to the Dutch retail community. The shift happened and TOM seems to stagnate now, probably having absorbed the quick wins. It still remains to be seen if others will follow suit despite Willem Meijers wishful thinking.

The larger picture

The FT wrote in 2012 about the stagnant European option markets in comparison to their US counterparts. This does not seem to be the case anymore looking at the various countries. The change is coming not only from TOM. The actual full European change is coming from one of the old pioneers of derivatives markets: Eurex.

Eurex challenges exchanges on their home turf

Market share in Belgian equity options

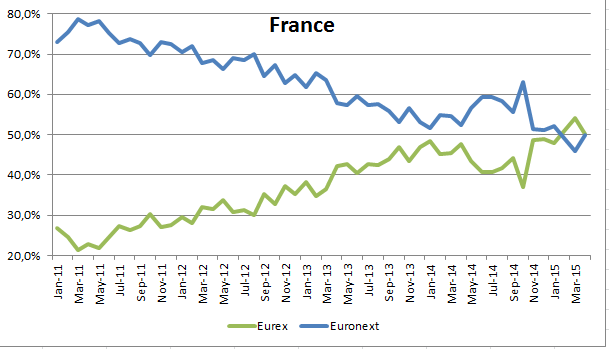

Looking at some graphs, we see some very interesting developments. The French market, once dominated by Euronext is now split into two with Eurex being slightly in the lead. The same trend for Belgium with both lines steadily going towards each other. This means that Euronext is being seriously challenged on three of their four option markets.

market share in French equity options

MEFF and IDEM

market share in italian equity options

The smaller option markets in Italy and Spain with overall volumes (Italy ca. 25Mio contracts and Spain with 33 Mio contracts) are experiencing a similar situation. For Italy, Eurex is creeping towards a 75 to 25 % split with IDEM and Spain is seeing a more volatile graph with a Eurex market share occasionally coming close to 40% for certain months.

market share in spanish equity options

What’s behind these changes?

It’s not just a fee argument as Eurex had lower fees than the other market places for a long time already. There is something new that makes market participants turn to Eurex: The current environment requires higher capital efficiencies for many participants. Eurex has an integrated European options market and a silo based model of trading and clearing. That facilitates higher capital efficiency.

Netting of derivatives positions (and soon cash equities) across all country segments result in large margin efficiencies and leads to considerable savings for banks. The transition to portfolio based margining is increasingly applied by more and more clearers and should be fully completed by the end of this year. The opportunity to net within such a complete portfolio is something none of Eurex’s competitors can offer at the moment.

Another point is simple economic efficiency in infrastructure: If you are a new entrant like a US firm coming to Europe or a European firm seeking direct membership, and you want the biggest reach via one single exchange connection, there really is only one exchange to consider.

Again, “Liquidity is sticky”? Perhaps, but liquidity also tends to come together. The answer to getting towards the most cost efficient market for participants may not lie with exchange competition and diversification after all. The answer might not even lie with the traders themselves. It might just lie with concentration on a single platform once the banks, and their mid and back office realize the full scale of potential efficiencies.

(*all shown statistics are ex Bclear statistics. Bclear stopped reporting individual country market shares when ICE took over. Last reported market shares were on average: 0,5% for Belgium, 5% for France, 5% in the Netherlands 5,7% for Spain, 0,8% for Italy and 2,3% for Germany)

Cornelius Müller is responsible for institutional sales at Eurex Frankfurt for the Dutch, French and Belgian markets and is based in Paris.